Live Tides

NOTICES TO MARINERS

Charts & Surveys

Incident reporting

Life-threatening emergencies on the river:

Call 999 and ask for the Coastguard

For near miss, safety observations and incident reporting click below

Annual Report and Accounts 2022

OVERVIEW

ABOUT THE TIDAL THAMES

The tidal Thames is 95 miles of river from Teddington Lock, through central London, out to the North Sea. The river is home to the UK’s biggest port, the busiest inland waterway for freight and passengers and a growing centre for sporting activity.

ABOUT THE PLA

As a Trust Port, we hold the Thames in trust for future generations. We have no shareholders, so operate for the benefit of customers and stakeholders now and in the future.

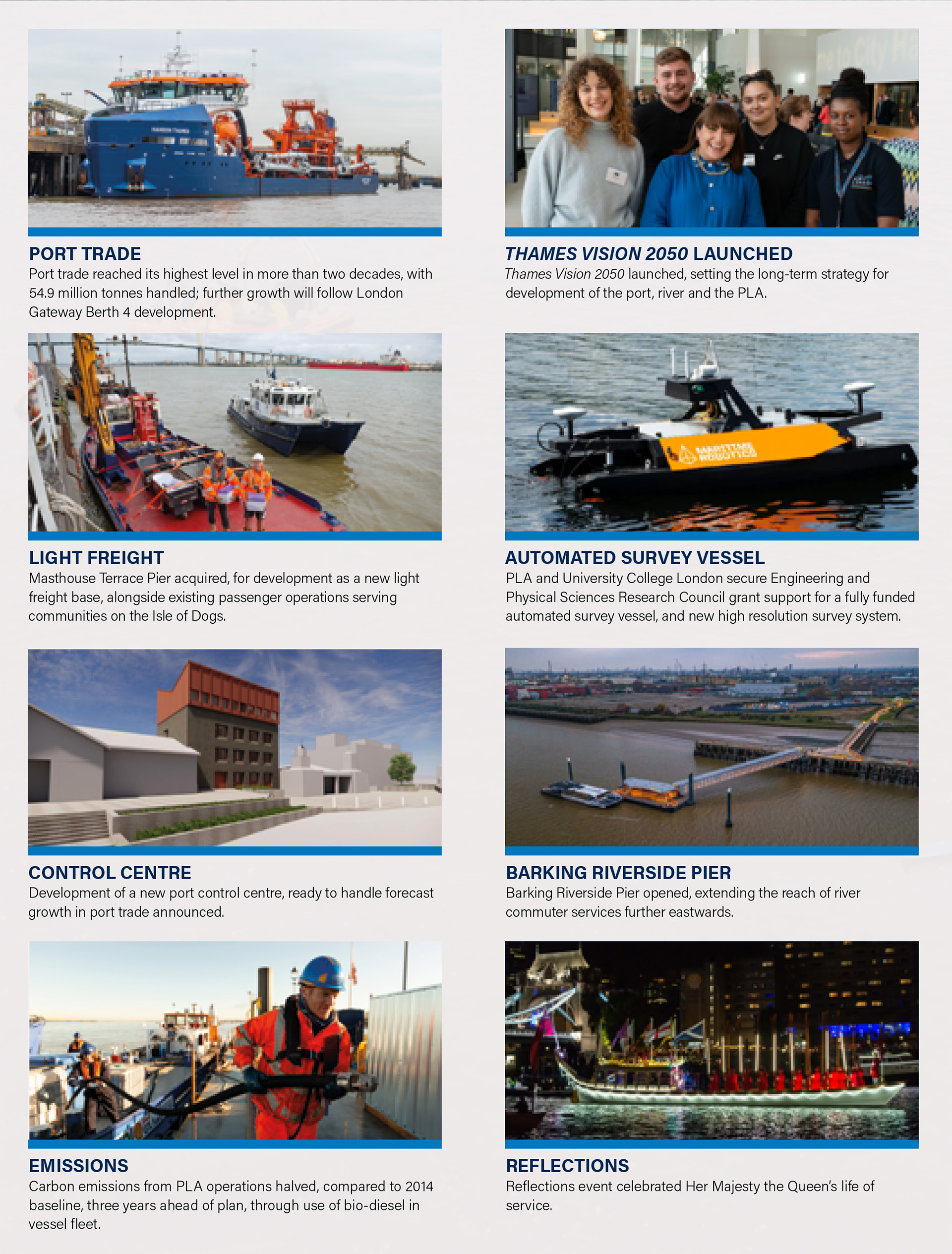

2022 AT A GLANCE

OUR VISION FOR THE THAMES IN 2050

The UK’s leading port, central to the nation’s economy, with Net Zero emissions. A clean river, free of pollution and rubbish, supporting more sport, passengers and freight. A resilient Estuary, adapting to climate change and richer in wildlife. A more diverse Thames, providing jobs, learning and enjoyment to the whole community, and always, everyone, staying safe.

Thames Vision 2050 is built around three interconnected themes, centred on the role the river plays for people and the environment.

Delivering the Vision: 2030 Action Plan

To deliver the Vision we are working to an immediate Action Plan, between now and 2030. We are working with partners to complete the following actions.

For the latest on Thames Vision 2050, visit: www.pla.co.uk/ThamesVision

STRATEGIC REPORT

CHAIR'S STATEMENT

JONSON COX CBE

At the PLA, we play an essential role in sustaining and improving the tidal Thames as trading hub, destination and natural haven. As custodians of the river, we aim to drive positive impact, reinvesting profits, supporting sustainable growth in port and river use, alongside an improving environment.

At the PLA, we play an essential role in sustaining and improving the tidal Thames as trading hub, destination and natural haven. As custodians of the river, we aim to drive positive impact, reinvesting profits, supporting sustainable growth in port and river use, alongside an improving environment.

Thames Vision 2050, launched last year draws together, and makes more ambitious our goals for the medium- and long-term evolution of the port and river. These are for the No. 1 Net Zero UK trading hub, a place to live, visit, play and enjoy, providing clean air, water and land supporting biodiversity and public use. It is fundamental for us that the river and the PLA is open and more accessible to all.

Safety underpins all elements of river use. It remains our prime focus. This ranges from the day-to-day oversight of operations in the UK’s largest port, to ensuring suitable continual skills development is established as a cornerstone of river operations.

The Vision was shaped in consultation with our diverse stakeholder community. We have engaged swiftly on the medium-term 2030 Action Plan of strategic partnering and targeted investment to deliver objectives of the Vision.

Continuing investment in our core pilotage service is an immediate priority, to meet our customers' growing demand of the UK's biggest port. The masterplan we will develop for the tidal Thames is also a major focus, enabling the PLA and partners to make ‘no regrets’ decisions for the development of the river.

The creation of the Thames continuous professional development (CPD) scheme, with the Thames Skills Academy (TSA) and the Company of Watermen & Lightermen (CWL) is an essential innovation. We are backing it with investment to ease access to simulator training, before CPD becomes mandatory from 2024.

Improving and protecting the Thames environment is a key theme of the Vision and focus for us as an organisation. The Vision sets clear and demanding targets for us, including to work with those responsible for the discharge of pollution to agree the steps to create a clean river, free of sewage and plastics.

The launch of the Vision demonstrates the continuing evolution of the PLA. We are much changed as a partner to our stakeholders and are changing too as an organisation. Over the next two years we will transform our marine control operations, with the largest investment in our core services in more than two decades. That will sit alongside our continuing drive for operational efficiency, and improving customer service and supporting innovation on the river, including trials of light freight delivery by river to central London.

Since joining as chair last April, I have witnessed first-hand the dedication of the PLA team to helping people make the most of the river, safely. To them I offer my sincere thanks.

My thanks also to the PLA Board and the contribution of all our Board members. In January 2023 we welcomed Vanessa Howlison as a non-executive, and chair of the audit and risk committee. Special thanks to Judith Armitt, Darren James and Alun Griffiths, who are concluding their time with the PLA after more than six years’ valued service.

Jonson Cox CBE

Chair

3 May 2023

CHIEF EXECUTIVE'S STATEMENT

Robin Mortimer

2022 saw substantial progress in the PLA, port and river community. Together we consolidated the foundations for sustainable growth and established a clear future path, through Thames Vision 2050. At the same time, the organisation delivered a strong performance across all key areas, from safety to financial results, in the face of growing economic headwinds.

2022 saw substantial progress in the PLA, port and river community. Together we consolidated the foundations for sustainable growth and established a clear future path, through Thames Vision 2050. At the same time, the organisation delivered a strong performance across all key areas, from safety to financial results, in the face of growing economic headwinds.

SAFETY

Safety is fundamental to our business. We work to help river users enjoy the Thames in safety and have the same health, safety and wellbeing commitment for our employees and contractors.

Our three-year Marine Safety Plan targets a 10% reduction in serious navigational incidents and we remain on track for this with a single incident reported in 2022.

Near miss reporting during the period rose by 80%, after a focused promotional drive. The navigational safety team worked closely with operators and river users along the Thames, providing expert counsel and advice to support greater safety on the river. To improve Thames safety over the coming years, we will be mandating Thames Continuing Professional Development from 2024.

At the end of 2022, Parliament passed new Regulations so that, from 2024, the Maritime & Coastguard Agency (MCA) will be applying modern safety standards to historic vessels operating on the river. This is a very welcome development, which the PLA has been keen to see for many years, and will address one of the most significant safety risks on the tidal Thames. We thank Department for Transport (DfT) and the MCA for making this happen, and we will be working with the MCA and Thames operators on the implementation of the new Regulations.

Personal Health & Safety was a major focus for the team through the year, with a reduced number of Lost Time Incidents, compared to the previous year and a review of all our risk assessments completed across the business. In a focused review, we came together as a cross company team to shape our future Health & Safety strategy.

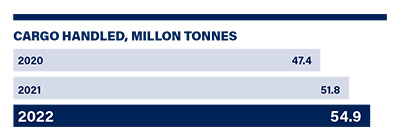

PORT & RIVER OPERATIONS

Trade in the port in 2022 was 54.9 million tonnes, increasing by 6% (2021: 51.8 million tonnes). London remains the UK’s largest port by volume of goods handled.

Pilotage acts in the year fell slightly to 13,699, as the mix of vessel types calling evolved (2021: 14,037). The service level was 98.5% (2021: 99.1%), remaining above our 98% target level. Fourteen trainee pilots joined the business in the year. Investment in continued pilot trainee recruitment is a key priority, in line with operators’ planned terminal developments.

Investment in Thameside terminals continues apace. DP World is developing the fourth berth at London Gateway and Forth Ports is completing commissioning of the building materials handling systems at Tilbury2. Both are partners with the Ford Motor Company and the PLA in Thames Freeport, which will drive future investment and growth. At the same time, ferry operator CLdN is increasing calls on the Thames and Stolthaven is advancing its jetty replacement works.

Prospects for growing use of the river for inland freight are extremely positive. Alongside the established use of the river for moving bulk materials, logistics companies’ interest in the Thames as a light freight route is at unprecedented levels. We are supporting and facilitating their trial river operations, while also leading studies into the pier adjustments needed to accommodate this new river use.

The recovery of passenger operations continued, post-COVID restrictions. More than eight million passenger trips were taken during the year, almost double the number in 2021. Investment in further piers and new vessels with cleaner propulsion systems is setting the sector up for long-term sustainable growth.

FINANCIAL PERFORMANCE

The organisation delivered a positive financial performance in 2022, as trade increased and we addressed business impacts flowing from the Russian invasion of Ukraine. The operating surplus of £12.2 million was up 40% on £8.7 million in 2021, on a turnover of £78.2 million (2021: 71.4 million).

For the medium- and long-term we are well set, with plans in place to manage the principal liabilities and cash available to make strategic investments which support delivery of Thames Vision 2050 goals.

INVESTMENT

We invested £4.7m in PLA capital projects in 2022, more than half in sustaining capital projects, including fuel tanks for bio-diesel, radar network equipment and repairs at Richmond Lock and Weir. Property related investment included the completion of site works at Plaistow and Royal Primrose wharves, and the acquisition of Masthouse Terrace Pier, which we will improve for existing passenger operations and develop a light freight hub.

Our major future investment will be in a single port control centre at Gravesend. This will provide us with a flexible and high-tech base from which to manage the demands of a growing port and busier, more complex river.

SUSTAINABILITY

Thames Vision 2050 sets out a clear ambition for the condition of the river and habitats. It also places a clear premium on the development of the Thames as the UK’s leading Net Zero trading hub. To support us in realising these ambitions, we have welcomed our first sustainability director to the PLA.

Our immediate priority has been to reduce carbon emissions from our operations, as we work to achieve Net Zero by 2040, or earlier. In 2022 we halved these emissions, compared to our 2014 baseline, three years ahead of target, by using bio-diesel from sustainable sources in our vessel fleet. This is an important stepping stone solution, as we look at the optimum long-term zero carbon options.

More broadly we are engaged with the ambitions of Maritime 2050, to decarbonise UK maritime. Our work leading the hydrogen highway consortium is progressing well and our Thames Green Scheme is incentivising operators in the port and on the river to use vessels with lower emissions and superior environmental performance.

Our ambition is to sustain a thriving port and thriving environment, side by side. Tideway will provide a once in a generation step change in river cleanliness. We are working now on consolidating those improvements, concluding a plan for cleaning the Thames, especially in terms of sewage discharges, plastics and other pollution in the river. We are engaged with our partners in the water companies and environmental regulators to advance this important area of work.

ESTUARY SERVICES LIMITED

2022 was the first full year of Estuary Services Limited (ESL) as a wholly PLA-owned operation. ESL transfers pilots to and from vessels transiting the Thames and Medway. During the year, the team completed 10,445 pilot boarding and landing operations. As part of our long-term fleet investment programme we placed an order for a replacement pilot cutter for the operation, due for 2024 delivery from vessel builders, Goodchild Marine.

LOOK AHEAD

The building blocks for a sustainable future are in place. The long-term goals for the PLA and river are captured in Thames Vision 2050. Our ambitions for health & safety, customer service and environmental improvement are clear. We have the scope for strategic investment in support of our ambitions for greater river use, wider participation and a cleaner river.

Everything we do for river users and stakeholders flows from the passion and commitment of the 460-plus people who work for the Port of London Authority and our subsidiary Estuary Services Limited.

Many of our team work on shift, and afloat in often challenging conditions. To everyone in the team, my thanks for your commitment and hard work in making this amazing natural resource safely accessible to our many customers and stakeholders.

Robin Mortimer

Chief Executive

3 May 2023

CHIEF FINANCIAL OFFICER'S STATEMENT

Julie Tankard

2022 was a positive year for the PLA as port trade grew to exceed our pre-COVID volumes. Financially we managed through a period when the Russian invasion of Ukraine prompted a 40-year inflationary peak, which drove up our cost base.

2022 was a positive year for the PLA as port trade grew to exceed our pre-COVID volumes. Financially we managed through a period when the Russian invasion of Ukraine prompted a 40-year inflationary peak, which drove up our cost base.

Turnover was £78.2 million (2021: £71.4 million) which was a 10% increase on the previous year. Income in all categories increased: vessel and cargo conservancy by 11%; property and investment related income was up 10% and pilotage income rose 7%.

Operating profit was £12.2 million (2021: £8.7 million) which recovered significantly because of the increase in income.

We continue to hold sufficient cash and reserves to service our long-term goals, invest in the business and reflective of our long-term liabilities. Cash plus short term and pooled investments at year end were £32.9m (2021: £36.8m).

Our investments are focused on sustaining and improving our core operational assets, supporting river use and diversifying our income.

Investment in our pilotage operations has been a major focus for more than five years, both in response to immediate demand and our customers’ long-term expansion plans. The financial impact of the pilotage business was a small profit of £0.1m (2021: loss of £0.7m); maintaining an on-demand pilotage service that provides a consistently high level of service availability is an expensive business model.

Our core infrastructure development projects include the proposed new Marine Control Centre, needed to cope with increased port trade and changing vessel technology forecast in Thames Vision 2050. This project will be a major focus for capital spend over the next three years; so far, we have borne the design and professional fees for the development of the planning application for the centre.

We are investing also in our IT strategy, including the server replacement programme, network upgrade, cyber improvements and replacement of many user devices. The re-roofing of our main operational base, Royal Terrace Pier, a listed structure, is underway.

Our Investment Plan has the twin aims of supporting delivery of the Thames Vision goal to increase river use and diversifying our income through river-related property acquisition. The 2022 purchase of Masthouse Terrace Pier, to be developed with dedicated light freight capabilities, alongside its continuing passenger operations, reflects this. Significant spend was made during the year on improving the river walls and strengthening the quayside at previous acquisitions, Plaistow Wharf and Primrose Wharf. With the works complete, Plaistow has now resumed cargo handling and river use. Acquiring and developing these sites takes time, but provides long-term income stream and capital appreciation.

The PLA’s defined benefit pension scheme continues to be a large financial cost to the business, despite no longer being open to new members. Following the latest triennial valuation, the PLA had to increase deficit repair payments and agree a funding plan with the Trustee which would automatically trigger further payments if the funding plan goes off course. In 2022, the PLA paid £7.4 million in deficit repair payments (2021: £4 million). Future service costs of the scheme have increased also, with total contributions from both employer and employee rising to 29.9% (2021: 22.7%), of which the employer is responsible for two-thirds.

During 2022 our pension scheme, like many others, was impacted by the mini budget of 23 September. Subsequently, the value of the pound fell dramatically, and the cost of borrowing increased significantly. As a consequence, companies running liability driven investments made significant cash calls to maintain the hedge on the pension fund.

At the PLA we were able to meet all cash calls and maintain our hedged position through available cash and divesting some liquid assets. Like many schemes, we have since reviewed our pensions investment strategy, with a view to ensuring a higher level of liquidity and reducing the risk profile.

The pension liability, as valued under International Accounting Standard 19, increased to £25.0 million, compared to £11.0 million in 2021. The increase in the pension liability was driven by a change in the discount rate, moving from 2% in 2021 to 4.8% in 2022, reducing the liability on the scheme significantly but being more than offset by the loss suffered on the assets and the minimum funding adjustment.

We hold a number of pooled investments from gilts, equities and credit funds which have historically performed well. After the challenging year for the financial markets, we took a loss on these funds, which moved from £13.8 million to £11.9 million. This loss was booked in the income statement. We will monitor these funds into 2023, but as the investment strategy is long term, we are not expecting to take a reactionary position in response.

The overall outlook for the PLA is positive. We are well placed for increased river activity and demand for our services. Our healthy cash balance will underpin the Investment Plan, as we continue to look to diversify our income, albeit borrowing costs will make that more challenging. High inflation and energy prices are a concern as we go into 2023, as is the geopolitical environment which remains unsettled.

Julie Tankard

Chief Financial Officer

3 May 2023

CHIEF HARBOUR MASTER’S STATEMENT

Bob Baker

Activity along the river last year was the closest we have seen to pre-pandemic levels. It was consequently pleasing to see safety performance continue in line with prior trends, with just one serious incident, by some margin below the three-year safety plan’s trend target.

Activity along the river last year was the closest we have seen to pre-pandemic levels. It was consequently pleasing to see safety performance continue in line with prior trends, with just one serious incident, by some margin below the three-year safety plan’s trend target.

This positive performance was underpinned by a wider range of activities, through our safety management system, patrols and enforcement action, where appropriate.

To help ensure continued focus on the minor accidents which can lead to more serious incidents in the long term, we focused on the promotion of near miss reporting. Our latest ‘Look out for each other afloat’ campaign ran from summer 2022 onwards.

The safety management system performance was assessed and reported to the Board by the PLA’s designated person, as required by the Port Marine Safety Code.

Through the year we put plans in place for our first Safe Boarding Week, looking to prompt the use of appropriate equipment for embarking and disembarking vessels. The week was successfully delivered in March 2023, with 265 inspections of gangways, ladders from berths, piers and linkspans, along the tidal Thames.

Pilotage demand moderated a little compared to prior years, with 13,699 acts (2021: 14,037), and the service level remaining above 99%.

To keep pace with projected long-term demand, we are continuing to invest in both pilot recruitment and additional equipment for pilots.

Fourteen trainee pilots joined the PLA in the year, two more than we have been able to train in prior years. In addition, we invested more than £300,000 in portable pilot units, for pilots to use guiding the larger vessels into and out of the port.

Safety of navigation is the organisation’s principal undertaking and is set to benefit from further investment to prepare for the projected long-term growth in port trade set out in the Thames Vision. The proposed Marine Control Centre at Gravesend will provide a single hub for overseeing safe operations in the UK’s busiest port and increasingly complex waterway.

Bob Baker

Chief Harbour Master

3 May 2023

OPPORTUNITIES AND CHALLENGES

This section covers the key opportunities and challenges that the PLA manages and to which we respond. The Governance section of this report provides details of the full array of factors we address through our risk management process.

OPPORTUNITIES

Long-term port trade growth remains a major opportunity for the PLA. The Oxford Economics port trade forecast we commissioned for the review of the Thames Vision sets out a median growth expectation at 72 million tonnes by 2050 (2022: 54.9 million tonnes), with the upper limit around 90 million tonnes.

Short- and medium-term investments and developments underline this growth expectation. Major operators in the port, including DPWorld at London Gateway and Forth Ports at Tilbury, continue to make and plan significant investments in their operations. Other operators, including Stolt, Stema, Tarmac, CEMEX and Hanson are shaping their businesses for the long-term, bringing new vessels into their fleets and developing land side facilities.

Thames Freeport is a further boost to prospects. The lead operators – DP World London Gateway, Forth Ports, Ford Motor Company and the PLA – project that Freeport status will underpin the creation of more than £1 billion of investment in new port infrastructure and 21,000 new direct and indirect jobs on its estate.

The emergence of unprecedented levels of interest in the river for moving light freight is a major opportunity for the PLA.

We are working with logistics companies, their customers and others to turn their aspirations into operational reality.

The Thames Tideway Tunnel, the largest project on the river in central London for over a century, will be completed within the next three years. Once operational, its principal long-term benefit will be a cleaner river. During construction, use of the river underpinned investment in vessels, tugs and barges. The scheme’s contractor requirements embedded higher standards on the river, a legacy for the future.

The expected long-term growth in activity on the river will result in demand for more skilled people. As the nature of vessel technology and river operations changes, existing workers will need to maintain and upgrade their skills. The establishment of the UK’s first Continuing Professional Development programme for inland waterways, developed with the Thames Skills Academy, the Company of Watermen & Lightermen and Thames operators, will help to address this.

The river framework, the Thames Vision 2050, sets a clear path for the development of the river and the PLA. The masterplanning process on which we are now embarked will give the broad scope of ambition spatial interpretation at local level. We expect this greater certainty to underpin investment and development of the river as trading hub, destination and natural haven.

As the UK’s biggest port by tonnage of goods handled and the largest inland waterways for internal freight movements, on the doorstep of the country’s largest concentration of population, there is a major opportunity for the Thames to be central to the development of a decarbonised economy. Operationally, we have a commitment and route to achieve Net Zero by 2040, or earlier. More broadly, our leading role in the Hydrogen Highway project places us at the forefront of development thinking around hydrogen in the marine environment and we will support the development of alternative fuels infrastructure on the Thames.

CHALLENGES

The challenges for the PLA encompass environmental, economic, technological and social factors.

Climate change is a significant issue facing all ports. In our response we will be mitigating the impacts of climate change, such as sea level rise and increasing extreme weather events. In adapting to climate change we will be working with key partners, including the Environment Agency who are looking at long term flood defence management on the river through their TE2100 programme.

We are recruiting actively to meet the increasing service demands of the growing port. In common with many UK employers, we have found recruitment to be increasingly difficult for specific skills and we remain concerned about the availability of quality candidates over the long-term. So far this has not proved to be problematic in the recruitment of trainee pilots, a major priority for the business.

The business is adjusting to technological change that is expected to advance at pace through the development of new propulsion and other ship technologies, for example. Managing safety in this more complex environment could prove increasingly challenging. Our principal response is scoping the development of a new Marine Control Centre at Gravesend, with flexibility designed in to respond to the changing demands of ship automation over the next 30 years.

Our IT systems are benefiting from significant review and upgrade to ensure robust operations. Cyber security is a major focus, with shipping lines and ports targets for IT system attacks. We are further strengthening the security of our systems and educating users as part of our precautions in this area.

Trade patterns and the make-up of cargo passing through the port is expected to change markedly between now and 2050. The import of fossil fuels for use in transport is a major part of port trade and is expected to reduce significantly; lower volumes of low/zero carbon alternatives are expected to replace them. We will pay close attention to the safety needs for transit and handling of any new fuels.

The PLA has an interest in a number of pension schemes, which provide an exposure to the movement in value of stocks, shares and other investment markets. Following the most recent triennial valuation of the main PLA pension scheme a new, more costly recovery plan has been agreed with the trustees. The scheme is very expensive, although the introduction of a new defined contribution scheme in January 2021 for new joiners has mitigated some of the long-term liability.

Demand for our pilotage service remains strong. To continue meeting the ‘on demand’ requirements of our customers, we are investing in new pilot recruitment and supporting infrastructure.

The Tideway scheme has presented a navigational safety challenge linked to the operation of 12 construction sites in and alongside the river. As the construction starts to ramp down, we are managing the continuing high level of consenting and other demands with a dedicated major projects statutory consenting team.

In an increasingly busy port and river, use of the finite space available has to be carefully managed. We work to balance the competing demands from trade, travel and recreation. Developments with potential to encroach on usable river space include new crossings and new or expanded windfarms.

In seeking to develop increased renewable energy generation capacity, the UK windfarm sector is expanding. A busy route for navigation to the UK’s largest port, the Thames estuary is already home to a number of large windfarm developments.

To ensure unimpeded safe navigational access to the port, all windfarm proposals are subject to careful consideration. We work actively on this with scheme developers, shipping lines, service providers and terminal operators who would be affected.

PLA STRATEGY

Thames Vision 2050 is built around three interconnected themes, centred on the role the river plays for people and the environment.

A responsive river

The next 25 to 30 years will see substantial change across the economy and society as we transition to a Net Zero society, and deal with the effects of climate change, alongside other opportunities and challenges. With stakeholders, we have agreed five cross cutting priorities for action:

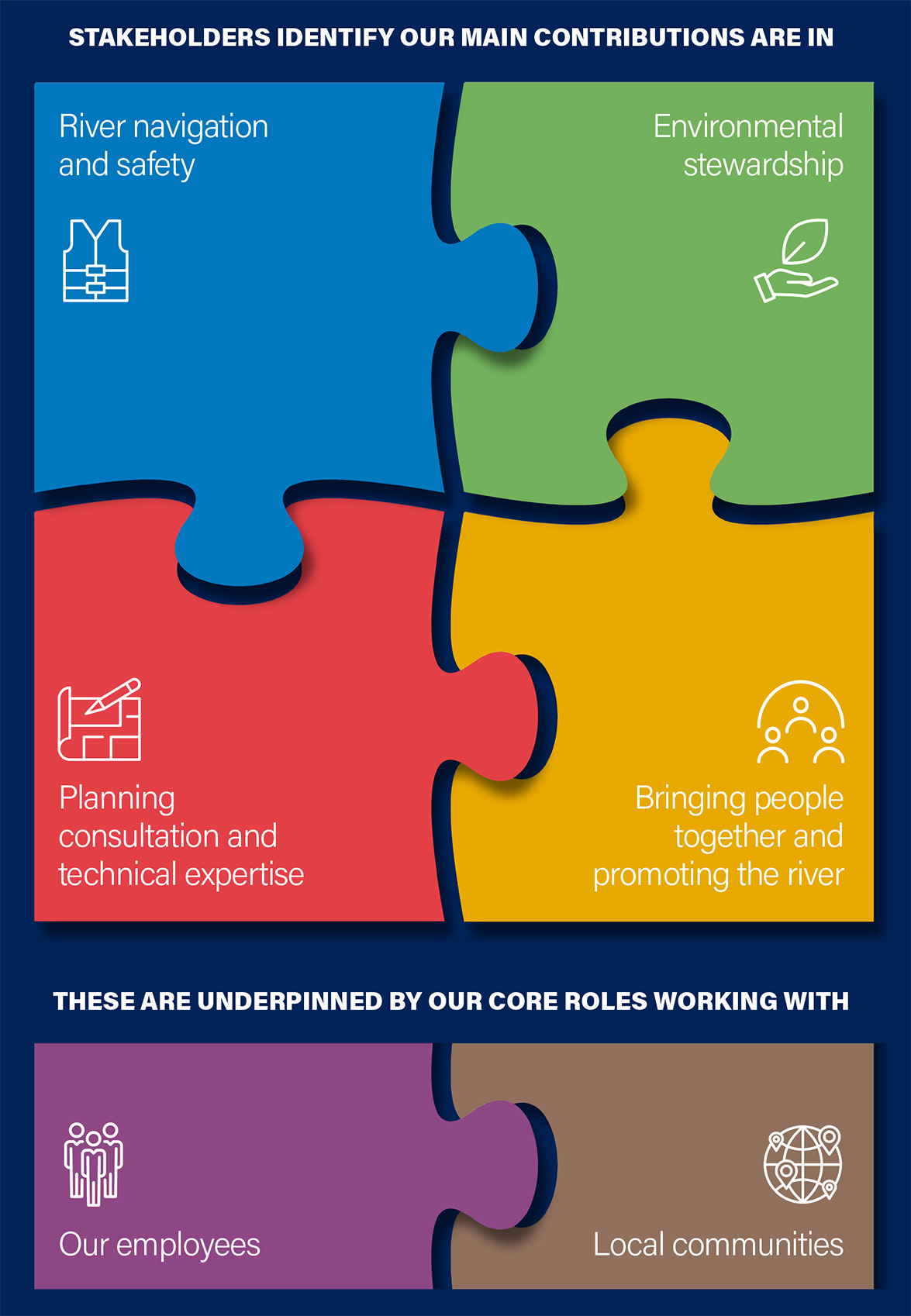

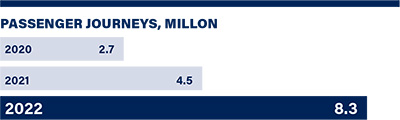

STAKEHOLDER BENEFITS

As a Trust Port we provide stakeholders with a range of benefits, alongside discharging our specific duties.

ENGAGING WITH STAKEHOLDERS

As a Trust Port we work closely with our stakeholders in maintaining a safe river, caring for the environment, and promoting use of the Thames.

Department for Transport guidance describes a Trust Port as: ‘a valuable asset presently safeguarded by the existing Board, whose duty it is to hand it on in the same or better condition to succeeding generations. This remains the ultimate responsibility of the Board, and future generations remain the ultimate stakeholder.’

In considering the long-term development of the river, the Board has regard to factors including: long-term consequences; how decisions affect our customers, employees and the wider community; minimising environmental impacts and improving the environment wherever possible; reputational implications; and fairly balancing different stakeholder needs.

In running the PLA, the broad stakeholder groups the Board considers are:

- Customers: river users (including operators of seagoing cargo vessels, inland freight vessels, passenger vessels and recreational users), commercial port operators (including the operators of cargo handling facilities) and others (including our licensees, tenants and those to whom we provide third party services)

- Employees

- Local communities and NGOs

- Government, elected representatives, regulators and local authorities

Board members remain in touch with stakeholders’ views through engagement, studies and visits including:

- Annual employee engagement study

- Annual stakeholder audit

- Annual stakeholder meeting

- Public meetings

- Site visits

- Customer meetings and feedback

The following tables set out the main types of stakeholders, their areas of interest, our engagement channels and how different Board Committees and the Board of Directors address stakeholder interests.

Areas of interest | Engagement channels | Committee/Board Agenda |

Customers | ||

|

|

|

Employees | ||

|

|

|

Local communities and NGOs | ||

|

|

|

Government, elected representatives, regulators and local authorities | ||

|

|

|

The table below sets out four key Board decisions in 2022 and the manner in which stakeholder views were drawn into the decision-making process. | ||||

Board decisions and their impact on stakeholders | ||||

Decision | How we took stakeholders into account | Long-term implications | ||

Thames Vision 2050 development |

|

| ||

Light freight |

|

| ||

Masterplanning |

|

| ||

Creation of a single Marine Control Centre |

|

| ||

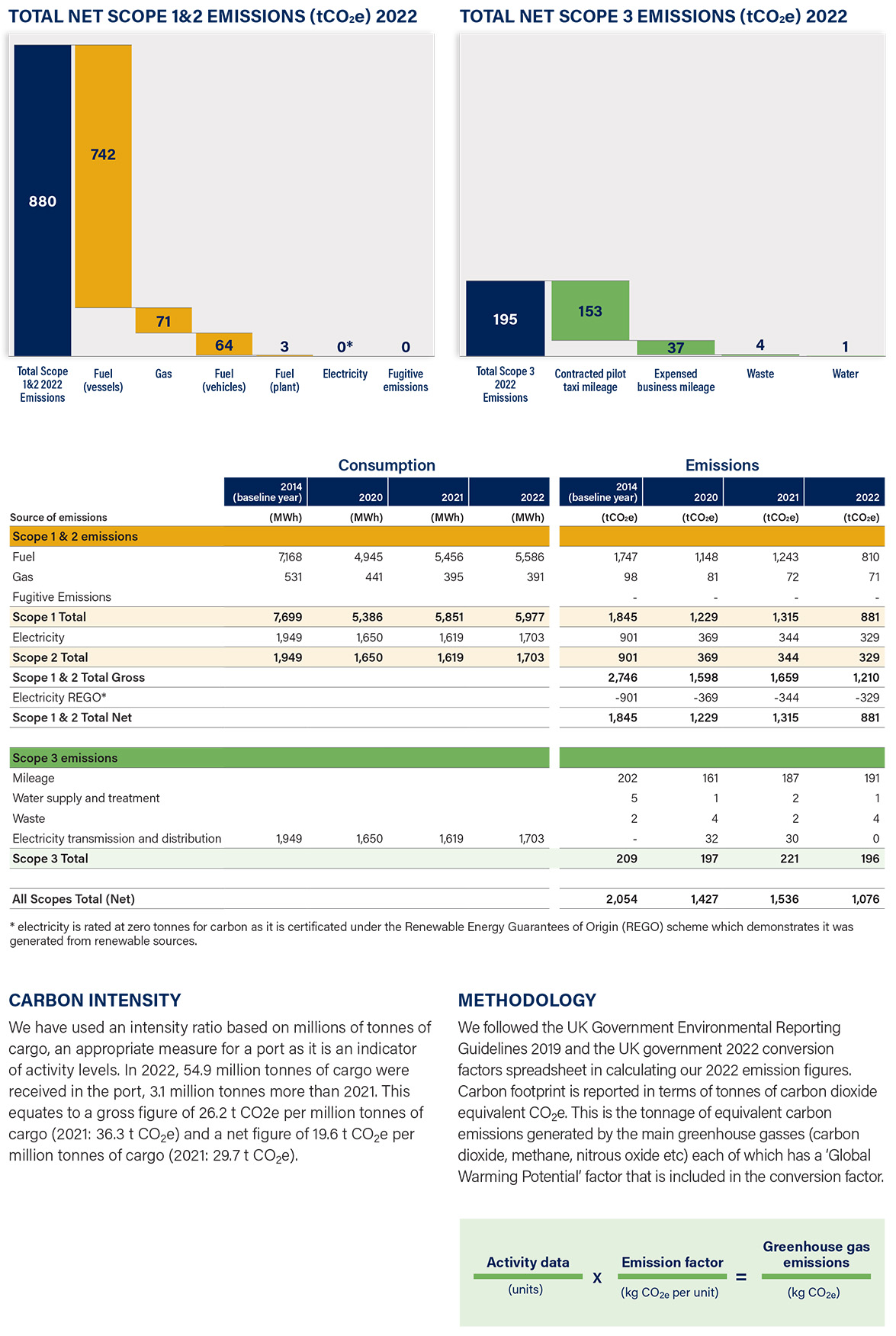

STREAMLINED ENERGY AND CARBON REPORTING (SECR)

We will achieve our net zero target through a combination of activities including:

The PLA has committed to be net zero by 2040 at the latest. Our main emissions sources have been mapped and plans are in place to reduce emissions.

PROGRESS AGAINST TARGET

We made substantial progress on our journey towards net zero in 2022, reducing our Scope 1&2 emissions by 52% from our baseline year of 2014.

This was achieved principally by transitioning our vessel fleet to sustainable biofuels (Hydrotreated Vegetable

Oil or HVO from sustainable sources), an interim measure to reduce our emissions, while we work with partners and suppliers on electrification.

We continue to invest in energy efficiency measures. Our marine operations site had all external lights switched from halogen to energy efficient LEDs at the end of 2021; total electricity use on site has fallen by 13% compared to last year. Renewable installations are being investigated on buildings, remote and marine assets for future applications.

We continue to purchase electricity from a 100% renewable energy tariff, backed by Renewable Energy Guarantees of Origin (REGOs), which the supplier classifies as zero emission. Our solar PV panels at London River House continue to provide renewable energy.

NEXT STEPS

In 2023 we will be refining and expanding our approach to Scope 3 (value chain) emissions reporting and reduction. We are currently reporting on contracted taxi mileage, waste disposal, water consumption, electricity transmission and distribution, and expensed business mileage.

In 2023-24 we will work on understanding and reducing emissions associated with major capital projects, as well as our supply chain more generally. At the same time, we will continue to work with partners across the sector to promote innovation around zero-emissions vessels and explore opportunities to strengthen shore power potential.

PERFORMANCE

RIVER USE 2022

PORT TRADETrade through the Port of London reached its highest level in more than two decades last year, with 54.9 million tonnes handled. Throughput was up by 6%, from the 51.8 million tonnes handled in 2021. Almost half the trade was in containers and unitised cargo, which was by up 4% to 24.4 million tonnes. London Gateway handled more than two million TEUs for the first time, consolidating its position as Britain’s second biggest container terminal. Building materials volumes fell by 5%, to 12.4 million tonnes as construction slowed. The largest increase was in oil products, up by 27% to 11.7 million tonnes as travel returned to more normal levels, post pandemic lockdowns. Long-term growth in port trade is expected, underpinned by investment by terminal operators. Work is underway at DP World London Gateway, on the £300 million plus development of Berth 4. At the Port of Tilbury, 40 new career positions were created as a result of new business growth working with a global brand in fast moving consumer goods and work continued on new silos and automated storage, consolidating the port’s position as the UK’s largest import and export grain handling facility. Stolthaven’s latest development project at Dagenham is focused on replacement of the jetty and installation of new, higher capacity lines. CLdN, the most frequent operator of services from the Thames to the near continent, is adding further services to increase capacity and trialling new environmentally focused vessel technology. Rotor sails have been fitted to vessel, Delphine. In the building materials trade, an important cargo on the Thames, 2022 saw the first call of new dredger, Hanson Thames. The vessel is part of wider Hanson investment in its Thames operations, at Dagenham and Victoria Deep Wharf. Thames Freeport is engaged in active marketing which partners – Forth Ports, London Gateway and Ford Motor Company – expect to underpin ongoing growth.  |  INLAND WATERWAYS FREIGHTInland freight movements between terminals on the Thames fell to 2.8 million tonnes, in 2022, down from 3.7 million tonnes in 2021. Volumes declined due to the combined effects of Tideway related traffic slowing and a reduction in the movement of aggregates for construction. Waste volumes moved increased slightly. Traditional bulk cargoes on the river include waste and construction products. An emerging ‘light freight' sector is developing on the river too, around the movement of small packets and parcels. The number of packages moved on the river in 2022 was 87,500 up from 52,300 in 2021. The longest established river user, Cory, is taking forward plans for Riverside 2, a second Energy from Waste facility at Belvedere. This is allied to an industry-leading decarbonisation project located at the site which has potential to deliver 1.4 million tonnes of CO2 savings per annum by 2030. At the same time, the company’s fleet renewal programme for both tugs and barges continues. The Tideway project developed at pace through the year. The tunnelling phase concluded in Spring 2022, when a boring machine broke through into the shaft at Chambers Wharf. The tunnel is projected to be operational by 2025. So far, the project’s use of the river has saved more than 650,000 heavy goods vehicle trips and around 27,000 tonnes of carbon dioxide emissions. The £2.6 million programme of essential improvement works at Plaistow and Royal Primrose wharves in Newham was completed. The wharves are now ready for river use again, with Keltbray operational on Plaistow Wharf. As part of its investment plan, backing river use, the PLA has spent £20 million in site acquisition and improvements readying them for operations. Royal Primrose Wharf is being marketed to operators. The PLA Investment Strategy is key to the development of light freight potential on the river too. Dartford International Terminal, acquired by the PLA in 2021, has been the downriver base for several light freight trials, the latest with Cross River Partnership (CRP) and GPS Marine, making multiple drop deliveries of stationery and cleaning products, ending at Woods Quay, next to Waterloo Bridge. Further PLA investment was made acquiring Masthouse Terrace Pier from Canal & River Trust for development as the first pier in the capital with space dedicated to the transportation by river of parcels and other light freight, alongside existing passenger operations. The Isle of Dogs location offers excellent connections to nearby Canary Wharf. The development of light freight on the Thames is being taken forward with partners, including Cross River Partnership and the Thames Estuary Growth Board.

| |

PASSENGER TRAVELThe recovery of passenger operations on the Thames continued in 2022, with the number of trips almost doubling to 8.3 million, from 4.5 million trips in 2021. The new Barking Riverside Pier opened in Spring 2022 as the site developers realise the potential of their Thames-side site. This is the latest pier in the network, extending it further east, and has already welcomed more than 100,000 passengers. Uber Boat by Thames Clippers offered school holiday trial services from Gravesend into the capital, which continue to prove popular. A number of operators are adopting clean diesel for their services and exploring other cleaner propulsion options. Thames Clippers is expected to take delivery of the UK’s first hybrid high speed passenger ferries this year. Wood’s Silverfleet’s new base, Woods Quay, won the London West RIBA Regional Award 2022.  |

SPORT AND RECREATION2022 was an important year for Thames sport and recreation, as the Boat Race returned to the river for the first time since the pandemic and the number of club events and competitions returned to normal. The Head of the River races also returned, with some 17,000 competitors taking to the water. The Great River Race was set to return for the first time since 2019. Following the passing of Her Majesty the Queen, the race was replaced with a memorial row in Her Majesty’s honour. With many people who enjoy cruising on the river returning to the Thames after some two years enforced absence, our 2022 pre-season briefing for members of the Tidal Thames Navigators Club was held at the Museum of London Docklands with presentations from the Metropolitan Police Marine Unit, the RNLI, and the PLA. Active Thames made a strong contribution, its annual grant programme seeing £150,000 contributed to 26 successful applicants; the value of grants offered increased from £90,000 in 2021. Active Thames encourages participation in watersports and walking, and the grants focused on groups identified as less likely to be active such as lower socio-economic groups and people with disabilities. Among those benefiting in 2022 were SilverFit, which aims to promote happier, healthier aging through physical activity, and the South London Scouts, which works with 14-25 year olds and ensures that those from lower socio-economic backgrounds are able to take part in paddling and sailing.  |

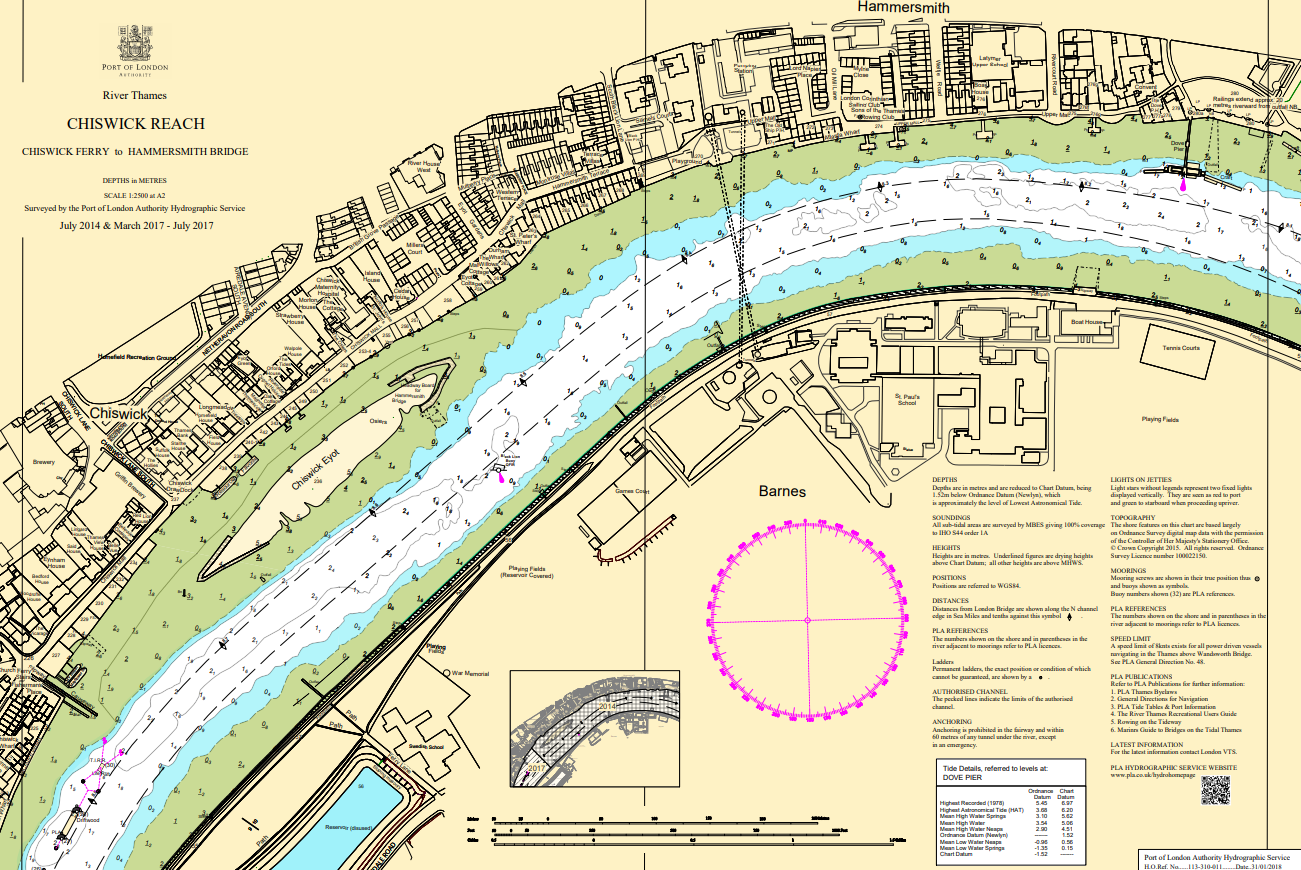

River navigation and safety

Our main responsibility is maintaining Thames river channels and managing navigation along 95 miles of the tidal Thames, downstream of Teddington Lock.

Our main responsibility is maintaining Thames river channels and managing navigation along 95 miles of the tidal Thames, downstream of Teddington Lock.

We put measures in place to assist safe navigation, including navigation lights and buoys, hydrographic services, pilotage and Vessel Traffic Services control centres at Woolwich and Gravesend, overseeing safe navigation over 400 square miles.

Highlights:

- Marine Safety Plan 2021 – 2024 on target for 10% reduction in serious navigational incidents.

- Significant increase in Near Miss reporting – 88 Near Miss Reports, 80% up on 2021.

- Fourteen pilot trainees joined as part of our continuing investment in the service.

- Sea pilotage service level 98.5% of all ship calls served as booked (2021: 99.1%).

- More than £300,000 was spent on new portable pilotage units, for use on the larger vessels entering the port.

- Continuous professional development (CPD) is set to become mandatory on the Thames from 2024.

- New, modern safety regulations for older Class V passenger vessels approved by Government.

Environmental stewardship

We conserve and enhance a range of diverse, thriving habitats for many different species of fish, birds, seals and other wildlife alongside the thriving commercial port and river activities.

We conserve and enhance a range of diverse, thriving habitats for many different species of fish, birds, seals and other wildlife alongside the thriving commercial port and river activities.

Our environment team works across an environmental agenda encompassing air quality, carbon emissions, habitats and water quality.

Highlights:

- Carbon generation fell to 1,076 CO2 equivalent tonnes (2021: 1,537 CO2 equivalent tonnes).

- Air quality monitors re-located to capture a river-wide perspective, after a period of long-term monitoring at Greenwich to assess the air quality impacts of berthing cruise ships.

- PLA-led Hydrogen Highway project continued, assessing scope to establish a national hydrogen highway network, integrating land, sea and port.

- 274 commercially trading vessels calling on the Thames qualified for the ‘green’ discount by achieving the required Environmental Ships Index standard; benefitting vessels collectively visited the port 1,070 times.

- Towage operator, Svitzer, named as second Gold member of the Thames Green Scheme, established to encourage inland vessel operators adoption of more environmentally friendly practices.

- All five Environment Fund projects tackling litter and invasive species were completed, positively impacting on the environment and increasing community awareness of environmental issues.

Planning consultation and technical expertise

Our planning and technical expertise is at the heart of our work to promote and facilitate greater use of the river.

Our planning and technical expertise is at the heart of our work to promote and facilitate greater use of the river.

This expertise is widely drawn on as we make sure wharves are maintained and reactivated for port use; provide expert advice to people looking to use the river, whether for trade, travel or leisure; and oversee major events on the Thames.

Highlights:

- Work started on the Thames Masterplan, a major Thames Vision 2050 commitment which will deliver certainty and clarity on opportunity for river users, regulators and local authorities.

- Development of plans for the Thames' first new boatyard in over a century continued to advance, with a prospective tenant secured.

- Applications for consent linked to major projects covered by Development Consent Orders (DCO) and other regimes, included the Thames Tideway Tunnel, the Silvertown Tunnel and DP World London Gateway’s Berth 4.

- Two further light freight trials supported, with PLA jetties playing a key role.

- Further work on our Harbour Revision Order (HRO) with stakeholders and the Marine Management Organisation; we are seeking the HRO to modernise the Port of London Act, under which we operate.

- Issue of Thames foreshore permits suspended, after consultation with our partners at the Museum of London and English Heritage, in order to protect the foreshore, imperilled by the increasing level of searching.

Bringing people together and promoting the river

The river is a hub of activity, whether for trade, travel and sports, and a catalyst for investment.

The river is a hub of activity, whether for trade, travel and sports, and a catalyst for investment.

At the PLA we are uniquely placed to act as the river’s advocate and convener for those interested in its use and development. This role sees us continually initiating new partnerships, working to develop established ones and showcasing the river in its broadest sense.

Highlights:

- The final consultation on Thames Vision 2050 was completed, feedback taken in and the document launched at City Hall in September.

- More than 25,000 people visited London: Port City, the major six-month exhibition we supported at the Museum of London Docklands.

- Port Infrastructure Group met three times, highlighting key projects for the ongoing development of the river.

- 120 people joined our sixth Environment Conference, which focused on climate adaptation, with speakers from the Wildlife Trusts, RPSB, British Ports Association and Lloyd’s Register Maritime Decarbonisation Hub.

- The second year of the Active Thames grant programme saw more than £150,000 worth of support for 24 organisations, promoting access to the river across communities.

PLA in the community

As a Trust Port, we look after the river for the benefit of many stakeholders and, ultimately, future generations.

As a Trust Port, we look after the river for the benefit of many stakeholders and, ultimately, future generations.

We are active members of the river and wider communities, generating benefits well beyond those of our core operations. Activity on the river generates Gross Value Added of more than £6 billion annually and supports in excess of 140,000 jobs across port and other operations, tourism and recreation.

Highlights:

- Total value of stakeholder benefit for 2022 totalled £48.9 million in 2022 (2021: £46.1 million).

- More than £300,000 contributed in support for activities, projects and partnerships that directly support charitable and stakeholder goals.

- Thames Explorer Trust (TET) schools outreach reached over 5,000 school children, on 58 separate school visits; teachers consistently rated the sessions as excellent, specifically referring to the coverage of Key Stage 2 National Curriculum objectives in Geography.

- One off donation of £12,000 to support Tilbury Seafarers Centre with installing a playing surface in the centre’s basketball court; the surface had fallen into disrepair during COVID lockdowns.

- PLA supported Thames Festival Trust providing admin support essential to delivery of the Reflections tribute to Her Majesty the Queen. The event raised more than £26,000 towards the construction of the new RNLI lifeboat station at Waterloo Bridge.

PLA people

The PLA team of more than 400 people provides a rare blend of seafaring and marine expertise, complemented by specialist electrical and marine engineers, planners, civil engineers, hydrographers, environmental and many other experts.

The PLA team of more than 400 people provides a rare blend of seafaring and marine expertise, complemented by specialist electrical and marine engineers, planners, civil engineers, hydrographers, environmental and many other experts.

In combination this group supports the 24-hour-a-day operations in the UK’s largest port and busiest inland waterway. They work closely with myriad stakeholders to support diverse uses of the river.

Highlights:

- Comprehensive Health, Safety & Wellbeing refresh completed: strategy created by a cross company team.

- 64 new joiners welcomed to the business, including 14 as trainee pilots.

- PLA received Department of Work & Pensions southeast employer ‘above and beyond’ award for work on the Kickstart programme.

- Two new apprentices joined to undertake Boatmasters qualifications: two upskillers are working through Level 4 engineering qualifications.

- In the annual JobCrowd survey, PLA ranked overall 25th in the top 50 UK employers, and 18th overall for graduates.

- Macmillan coffee morning fundraising supported, and monies raised matched by the PLA.

- Thames Vision 2050 engagement sessions held within the business, engaging employees in the river development strategy.

STAKEHOLDER BENEFITS

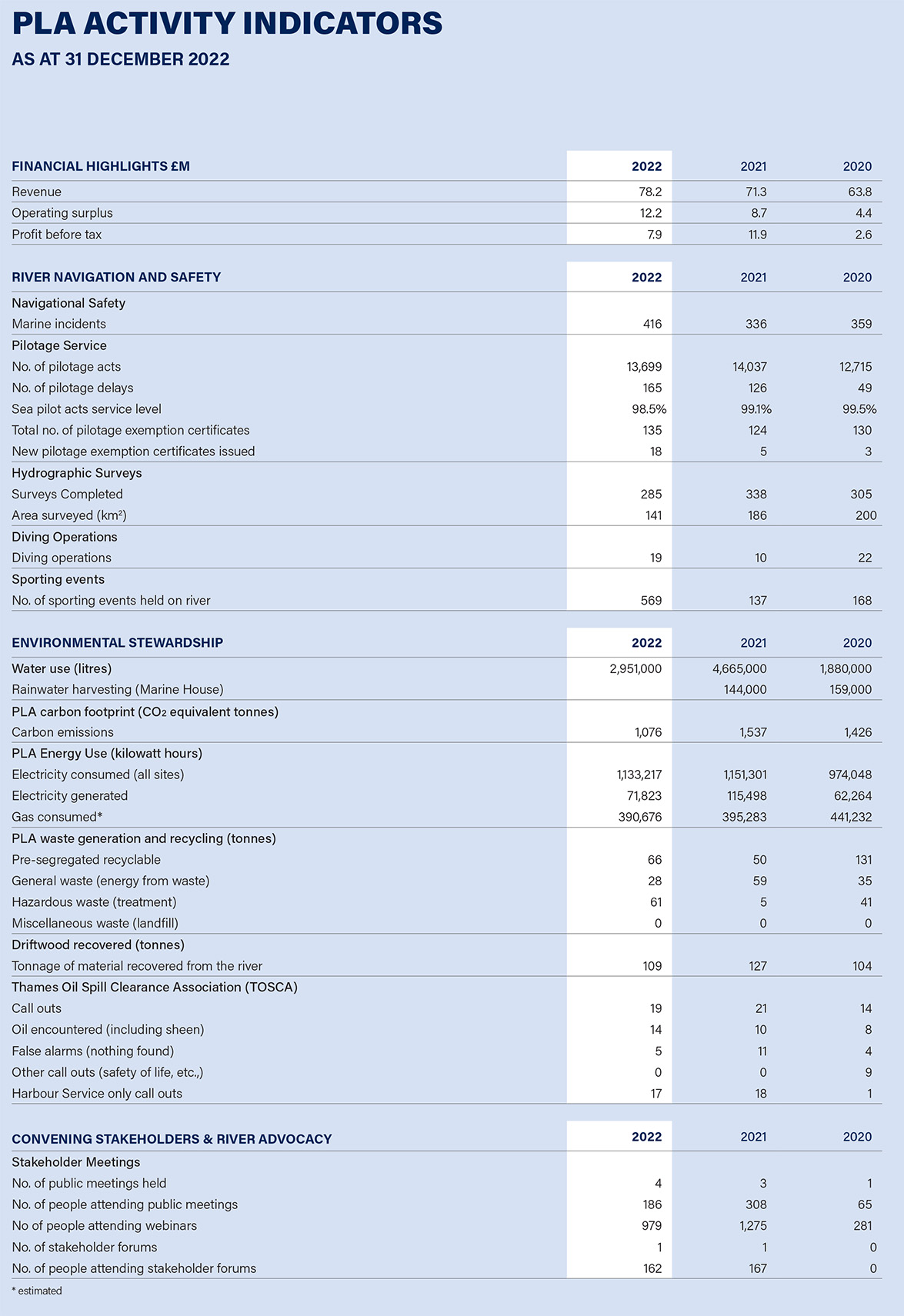

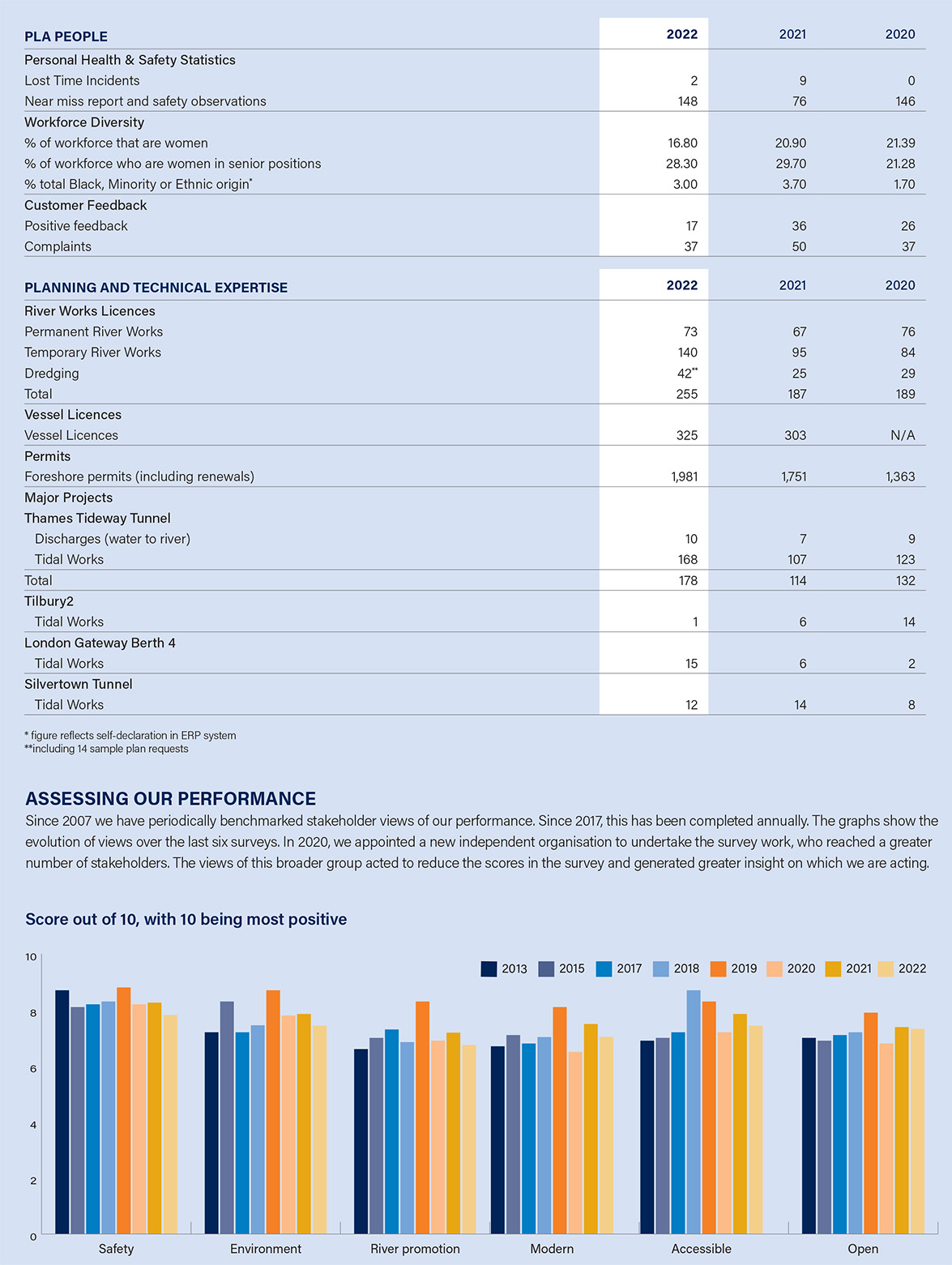

PLA ACTIVITY INDICATORS

As at 31 December 2022

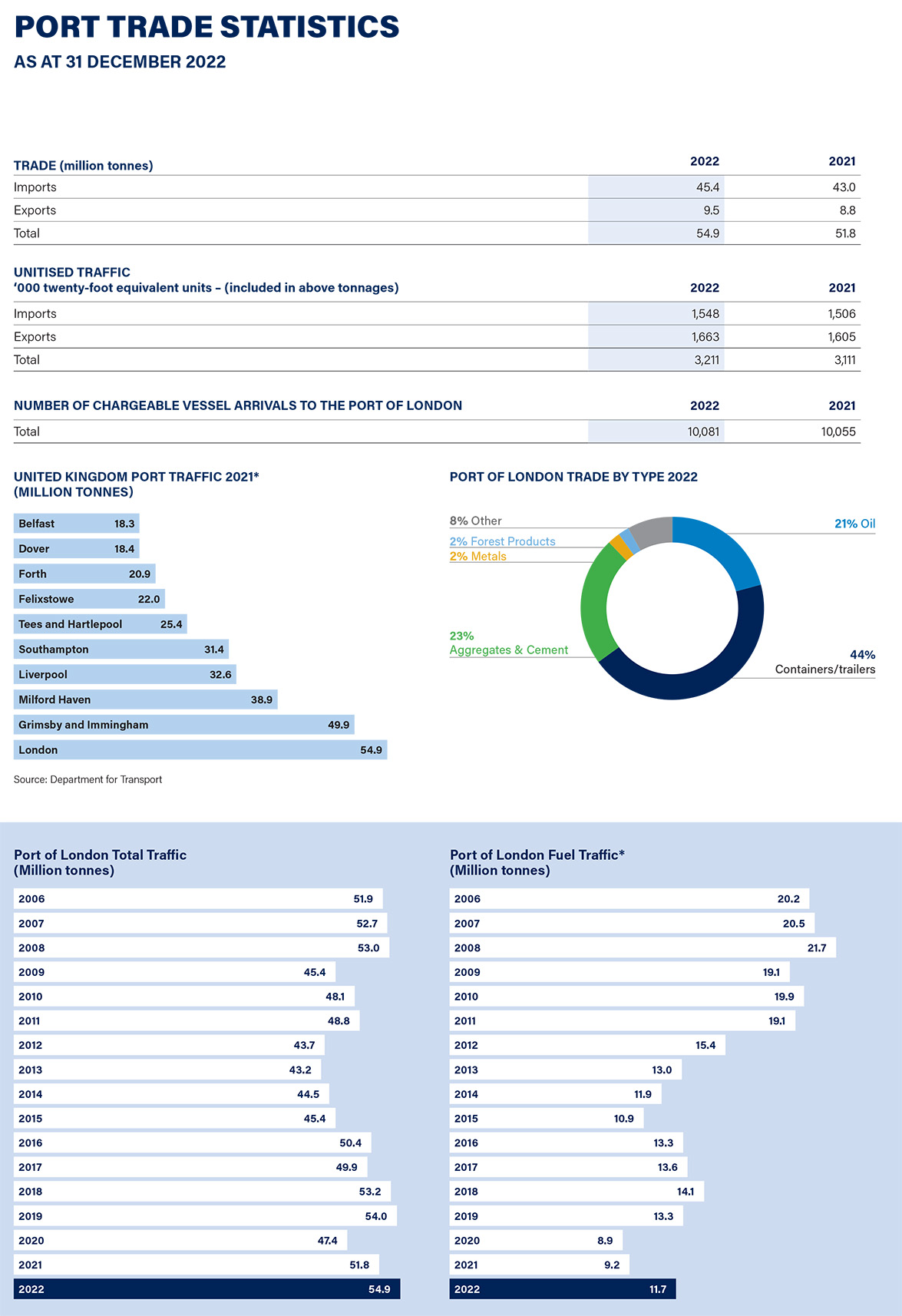

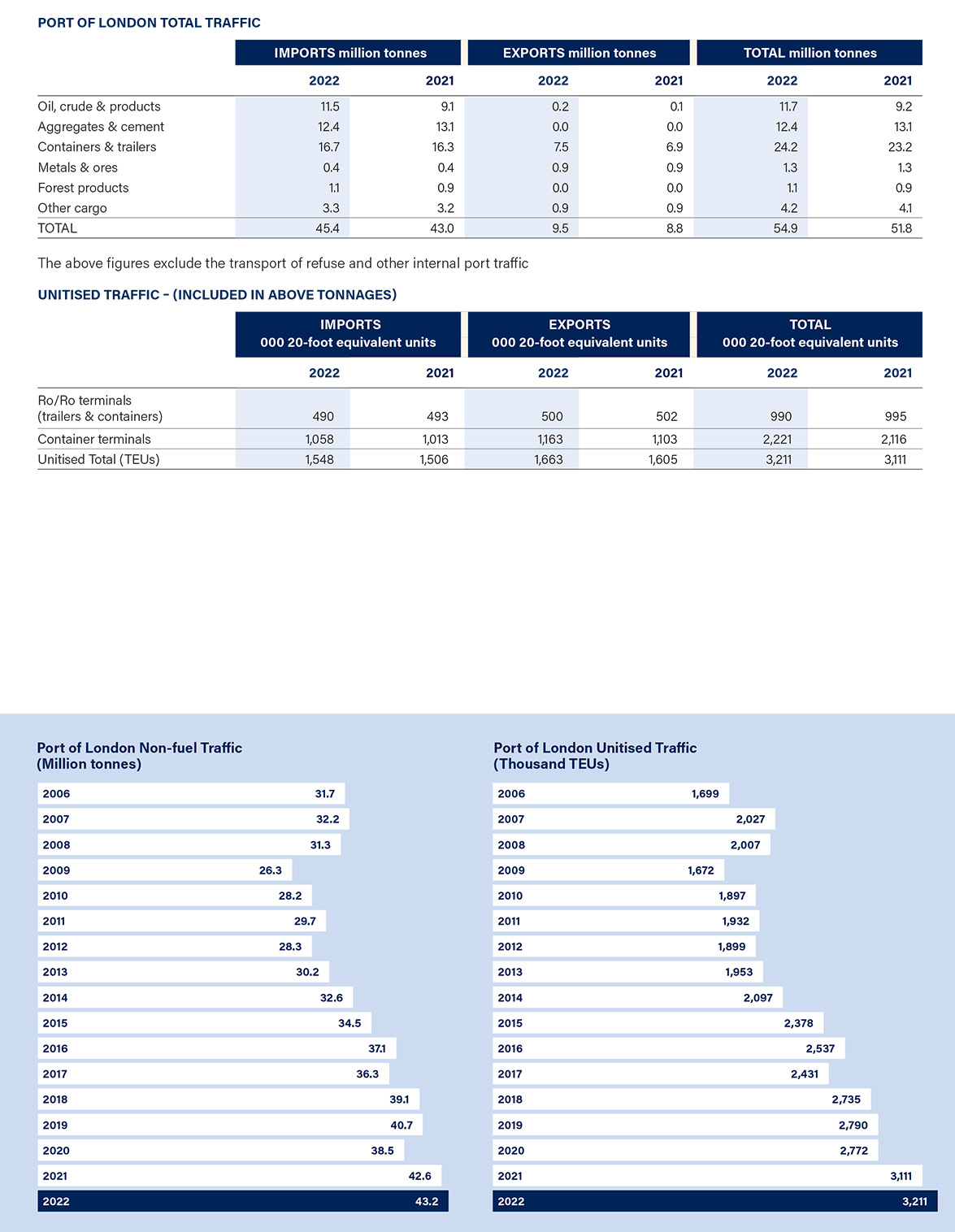

PORT TRADE STATISTICS

As at 31 December 2022

REVIEW OF PRINCIPAL RISKS

This statement captures the collective view of the PLA Board and Executive Committee of the principal risks that the business works to manage.

The key risks spread broadly, across safety, operational, economic aspects, cyber security, pandemic and climate change. Reputational risk is not given a separate listing; it is inherent in failing adequately to deal with the key risks identified here.

SAFETY

Numerous mitigation systems are in place on the river, including an effective navigational Safety Management System (SMS), risk assessment/hazard reviews, Vessel Traffic Services (VTS), pilotage, hydrography, Passenger Boat Code of Practice, Automatic Identification System (AIS), RNLI and London Coastguard, special signal lights and speed control byelaws. The PLA also hosts safety orientated initiatives, such as seminars and works closely with security services.

In the context of growing volumes of river traffic, the continued trading of historic passenger boats, with the risk of significant loss of loss of life if one of these vessels was involved in a collision and foundered, has been a major concern. Government approval of Maritime & Coastguard Agency (MCA) technical requirements for older Domestic Passenger Vessels, more comparable with modern regulations, is very welcome. We are publicising the requirements of the new Regulations before they come into force in late 2024.

Personal Health & Safety is a core value of the business, managed through personal responsibility, our Golden Rules – Care, Challenge and Comply – and our safety management system. During 2022 we updated all risk assessments and implemented training for key personnel.

OPERATIONAL

The most significant operational risk to the business would be the closure or partial closure of the port, significantly disrupting or halting operations and trade. There are several possible causes including, but not limited, to:

- collision;

- grounding;

- foundering;

- deliberate terrorist / pressure group action; and

- significant cyber security incident.

Mitigations include effective navigational SMS, risk assessment/hazard review, VTS, pilotage, and hydrography. Historically, we have responded effectively to clearing navigational channels, if engaged to do so; our Marine Services team and the vessel London Titan are key to this capability. We also participate in the Thames Security Forum and resilience groups.

ECONOMIC

A fundamental shift in the micro or macro financial environment in which we operate has the greatest potential to impact the Port of London in general, and our finances in particular. This includes changes in trade such as business cessation of a major customer or change in the consumer market, through to national or international economic factors such as a change in global trading patterns, or the impact of climate control.

The global economy continues to adjust to the impacts of the Russian invasion of Ukraine, which started in Spring 2022. These include trade sanctions, with inflation rising rapidly as energy and other commodity prices increase. For the UK, reliance on Russian oil products, particularly diesel, is expected to result in further supply tightening in 2023.

This is a fundamental change in economic conditions, after more than a decade of low inflation and low interest rates, rising costs along with Government policy to aid recovery from COVID-19 has created increased taxation for businesses.

Debt management protocols are in place and international exposure is minimised as far as is possible. Five-year business plans, as well as an annual forecast and budget exercise, are undertaken.

FINANCIAL

UK economic policy has the potential to reduce the financial performance of the PLA as the country enters recession in 2023. The port’s mix of cargoes and diversity of income streams should help to cushion any impacts. We have agile financial plans to adjust our cost base swiftly, and customer communications to help anticipate significant change in sufficient time.

There continues to be a deficit on an actuarial basis on the PLA Pension Fund of £49 million. Updated actuarial assumptions have reduced this deficit; as interest rates rise, liabilities have fallen. We completed the triennial valuation of the scheme during 2022 and have increased the employer deficit repair payments to the satisfaction of the Trustees and employer and provided further contingency in the form of a negative pledge on an asset. The Defined Contribution scheme launched in 2021 has replaced the Defined Benefit scheme for new employees; the Defined Benefit scheme remains open to future accrual and this continues to be a financial liability for the PLA.

The PLA pension scheme had a proportion of its assets in liquidity driven investments (LDIs); the abortive economic plans announced in the UK September 2022 fiscal event created great volatility in the gilts markets which caused a significant cash call on the LDI’s. We had sufficient cash to meet the demands and maintained our hedged position throughout this volatile period. Following this, the pension trustees will be re-evaluating the pension investment strategy to ensure it is fit for purpose.

The Pilots National Pension Fund, a multi-employer scheme, also has a substantial deficit in which the PLA has a share, in the region of 6.8%.

It is a long-term open-ended industry-wide liability over which individual employers have little influence. An industry-wide repair plan is in place which, in common with many ports, is funded by way of a levy on pilotage charges.

We are working with industry bodies and stakeholders to understand the impact of the Seafarers Wages Bill, which will be enacted during 2023. Further guidance and detail on tariffs will be studied closely, to understand the practicalities of enforcement, which will be challenging.

SIGNIFICANT CYBER SECURITY INCIDENT

All businesses face the possibility of a successful cyber security breach. Threats vary in complexity and sophistication and can potentially negatively impact organisations of all sizes. We deploy a range of industry-standard security products, both internally and on our network perimeters. Formal security and IT ‘conditions of use’ policies are established, which define security standards and acceptable use.

Office-based staff receive security awareness training and guidance on detecting ‘phishing’ and other malicious emails, and we continue to enhance data governance processes including formalised data retention and classification policies. We continued to increase our technical cyber security measures in 2022 through both hardware and software upgrades.

CLIMATE CHANGE

Climate change is one of the principal risks to which we have to respond. As a port handling more than 10 million tonnes of cargo a year, we voluntarily complete and submit Climate Change Adaptation Reports to Defra, as required under the Climate Change Act 2011.

In responding to climate change, the UK Government has made a legally binding commitment to achieving a Net Zero Carbon economy by 2050. This will result in wholesale change across the economy, and the ports that serve it.

For the PLA major changes that are likely, or potentially likely, to result from this transition include: the long-term switch from oil related cargoes to other forms of energy (currently representing around a quarter of port trade and a major source of income); development of new cargoes; existing vessels’ propulsion systems becoming obsolete; need to adopt new technologies; dealing with unforeseen legislative changes; and managing the impact of extreme weather on the business.

In managing this risk, we are implementing a detailed plan to become a Net Zero organisation by 2040. As an immediate measure, we are replacing the fuel in our vessels with bio-fuel, a change that requires few infrastructure adjustments. We are taking further steps to improve the energy efficiency of our buildings in planned refurbishment programmes and will be developing a detailed plan in 2023. The long-term view of the port, Thames Vision 2050 incorporates themes of decarbonisation, patterns of resilience and developments in vessel autonomy. Oxford Economics produced a forecast for cargo flows into the Port of London, assuming various decarbonisation scenarios, to inform our long-term planning.

PANDEMIC

The outbreak of the coronavirus demonstrated the potential impact of pandemics on the global economy as a whole and operational resilience within transport and logistics. We demonstrated our operational and financial ability to respond to pandemic through 2020 and 2021.

LONG-TERM VIABILITY STATEMENT

The Board has assessed the viability of the company’s business plan over a three-year period in detail, taking account of the company’s current position and potential impact of the principal risks documented in the corporate risk register.

The Board has a reasonable expectation that the company will be able to continue in operation and meet its liabilities as they fall due over the period to December 2025.

In making this statement, the Board has considered the resilience of the company, taking account of its current position, the principal risks facing the business in severe, but realistic scenarios and the effectiveness of any mitigating actions. This assessment has considered the potential impacts of these risks on the business model, future performance, solvency and liquidity over the period.

GOVERNANCE

Governance information for the year ended 31 December 2022 are available in PDF format here.

FINANCIAL STATEMENTS

Financial data for the year ended 31 December 2022 are available in PDF format here.

Annual Reports

- Annual Report and Accounts 2024

- Annual Report and Accounts 2023

- Annual Report and Accounts 2022

- Annual Report and Accounts 2021

- Annual Report and Accounts 2020

- Annual Report and Accounts 2019

- Annual Report and Accounts 2018

- Annual Report and Accounts 2017

- Annual Report and Accounts 2016

- Annual Report and Accounts 2015

- Annual Report and Accounts 2014

Discover