Live Tides

NOTICES TO MARINERS

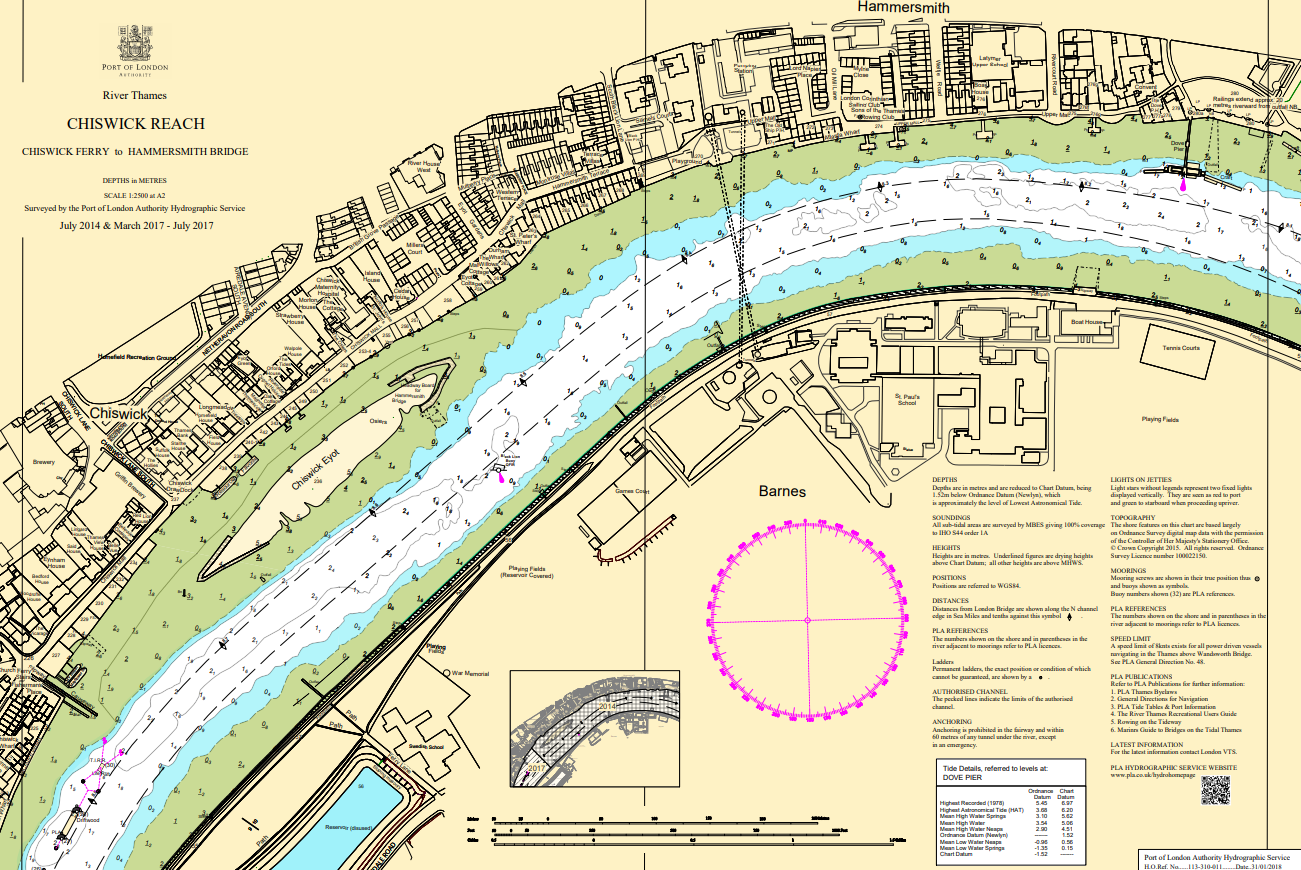

Charts & Surveys

Incident reporting

Life-threatening emergencies on the river:

Call 999 and ask for the Coastguard

For near miss, safety observations and incident reporting click below

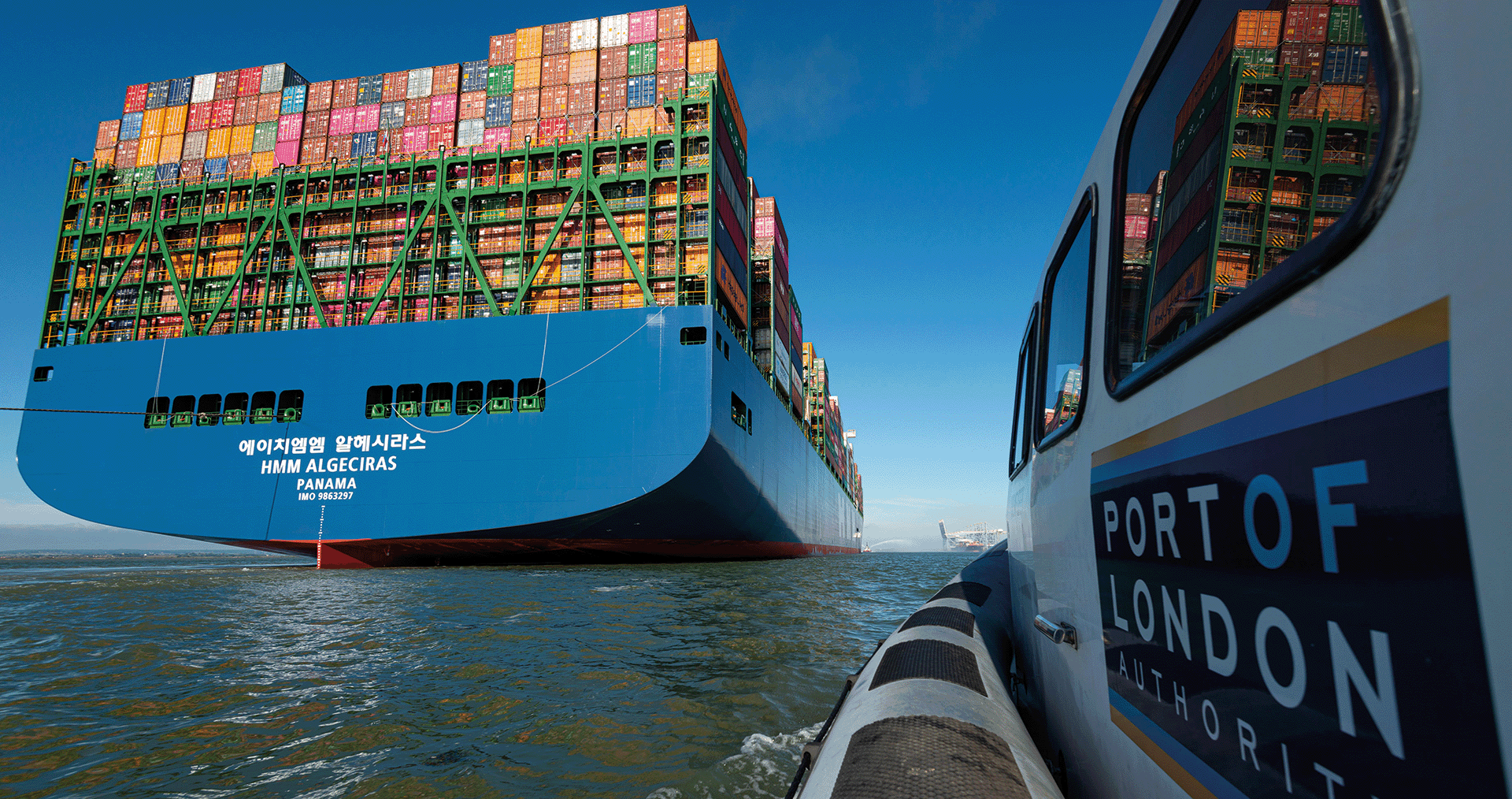

Trading Thames

Forecasts show that between now and 2050, trade in the UK’s biggest port will continue to rise to meet growing demand, from 50 million tonnes annually to 70-80 million tonnes

Continued investment will be key to achieving sustainable growth in port trade.

The forecasts show this growth in the context of transitioning to a Net Zero UK economy.

The river will also become integral to light freight logistics and last mile delivery to supply London.

Voices from the river

We asked key partners about the future of the deep sea port, conventional and light inland freight.

• Paul Dale, Port of Tilbury

• Ernst Schulze, DP World

• John Spencer, GPS Marine

• James Trimmer, Port of London Authority

RESEARCH FINDINGS

The outlook for Trading Thames draws on two pieces of research.

An economic impact study completed by SQW, released in Spring 2020, shows the tidal Thames to be an economic powerhouse, supporting 48,000 full time equivalent jobs, direct and indirect. The port and river complex delivers an annual gross value-added economic contribution of £4.5 billion, with investment over the five years after the survey (2020) projected to exceed £1 billion.

To establish a view of the port and river’s long-term prospects, we commissioned a port trade forecast, Future Trade Through the Port of London – alternative decarbonisation and growth pathways.

Growth in deep sea trade is expected to derive from increased volumes of unitised trade and building materials. Liquid bulk tonnages, particularly petroleum products, are projected to decline through the 2030s, with alternative fuels and feedstocks coming in over time, in smaller volumes.

Serving the largest concentration of population in the UK, the port is well placed to play an essential role in the handling and supply of these new fuels, including hydrogen. Work completed for the PLA by Royal Haskoning indicates there will be strong demand for these alternatives in both the port and for the inland fleet.

For inland waterways freight, Oxford Economics projected volumes would range between 1.9 million tonnes and 7.3 million tonnes (median 4.3 million tonnes). This takes account of a potentially major change in the composition of cargoes – with ‘light freight,’ (eg: consumer products) growing in significance, whilst bulk cargo volumes (eg: waste and building materials) remain broadly constant.

The potential to increase freight connectivity between the port and destinations in the capital, a hub and spoke operation, is seen as a major opportunity. This is allied to unprecedented interest in using the river to carry light freight.

Moving additional volumes of freight by water will, in the short-term, bring carbon reduction benefits as waterborne freight movement provides radically lower carbon emissions than road transport, cuts road congestion and improves safety. This is an attractive option for companies looking to satisfy their customers’ increasing sustainability demands.

Inland freight’s value is in getting goods into the heart of the city, where land use is mixed. The development of ‘clusters’ of industrial activity discrete from residential development can be helpful in ensuring wharf operating hours are not limited.

The development of Peruvian, Plaistow and Royal Primrose wharves, clustered with other industrial activities in Newham, is a good example of this.

Over the longer term, the adoption of cleaner fuels and propulsion systems will consolidate the river’s position as a clean logistics highway.

Cory, one of the UK’s leading recycling and waste management companies, has plans to develop carbon capture and storage at its energy from waste operation on the Thames.

The project could deliver 1.5 million tonnes of CO2 savings annually by 2030, providing an opportunity for the Thames to become a centre for shipping carbon for subsea storage, potentially benefiting other industrial operators.

The development of a vibrant Trading Thames will draw on success in all of the priority areas for action, particularly technology, the Net Zero transition and resilience. More of the river’s potential as connecting infrastructure, joining businesses and people, will be realised, providing a relief valve for increasing landside congestion.

Over time, developments in the circular economy as part of the drive for greater sustainability will have impacts on both port and inland freight trade; this is an area we will observe closely.

SPOTLIGHT ON

The UK’s leading port

The Thames is the UK’s largest port by volume of cargo handled. It sustains more than 48,000 full time equivalent jobs and an annual gross economic value added in excess of £4 billion.

The port is on the fast track for growth. The major project Tilbury2 is complete and operational and construction of the fourth berth at DP World London Gateway is underway. In addition, Thames Freeport is now operational and set to turbo charge growth, providing levelling up benefits for the local economy and community.

Growth at scale, driven by ‘mobile’ international funded private sector investment, will need to be matched with supporting development of landside infrastructure.

The resilience and flexibility of power generation and supply infrastructure will become ever more important as port operations increasingly switch to electric power.

The Thames is well placed to benefit from changing trading links, as the UK has now left the European Union. On short sea routes, the unaccompanied trailer operational model is well suited to post-Brexit operations. More broadly, the port’s trade has a strong deep sea, non-European emphasis, on which changed customs arrangements have no impact.

The Lower Thames and Silvertown crossings are important developments, but need to be allied to further improvements to rail connectivity and ongoing investment in local road improvements.

SPOTLIGHT ON

Light freight

Research by WSP, commissioned by the Thames Estuary Growth Board and the PLA, has confirmed enormous potential for handling light freight, at scale.

Moving millions of parcel deliveries from the road to the river would change the competitive position of light freight movements on the Thames, delivering jobs, reducing congestion and pushing London forward on the path to reduced air and carbon emissions.

WSP’s calculations suggest that if just 3% of the almost one billion parcels destined for London a year by 2050 were moved by river it would make the mode competitive. Successful development of light freight at scale is likely to depend on the use of existing river assets, particularly piers. To turn this into reality, the PLA is undertaking pier adaptation research to establish the changes needed to enable electric delivery bikes and other options to access the pier, transiting up and down the brow linking the pontoon and the riverbank.

This is one of the WSP recommendations, others include realising the environmental and wider society benefits of river freight, and supporting the development of proof-of-concept trials, including the DHL service and CEVA trials.

Explore the Thames Vision 2050

The Thames Vision is built around three interconnected themes, centred on the role the river plays for people and the environment.

The No. 1 Net Zero UK commercial hub

The country’s largest and most competitive port, closest to the UK’s biggest market, producing Net Zero emissions. Improved connectivity to road and rail infrastructure. Technologically innovative, expanding the transportation of light freight into central London as urban logistics transform.

A place to live, visit, play and enjoy

Accessible to all, a national and international icon for the city and the country. More visitors, drawn to the river as the best way to enjoy London and the Thames Estuary, and its many cultural attractions. More people from diverse backgrounds enjoying sport and leisure opportunities on the Thames.

Clear air, water and land

A clean river, free of sewage, waste and other pollution, supporting greater biodiversity and recreational use. Valued for its clean air, natural flood defence, wildlife and as a carbon sink.

Discover